In the midst of this populist backlash, I'm making a prediction. And the prediction is that the only group that can successfully cut spending are the Progressives. And spending will not come under control until they do it. That may be heresy. It is also unavoidable.

The reason Progressives will own and shape any significant deficit reduction is simple. They own the narrative in academics, the media, and in politics. Even the majority of Republicans, including Tea Party candidates, accept the Progressive narrative. That means that any plan practical enough to withstand the withering storm of the media and pass the political arena must a priori pass Progressive tests. Look to the latest in federal and banking legislation for proof.

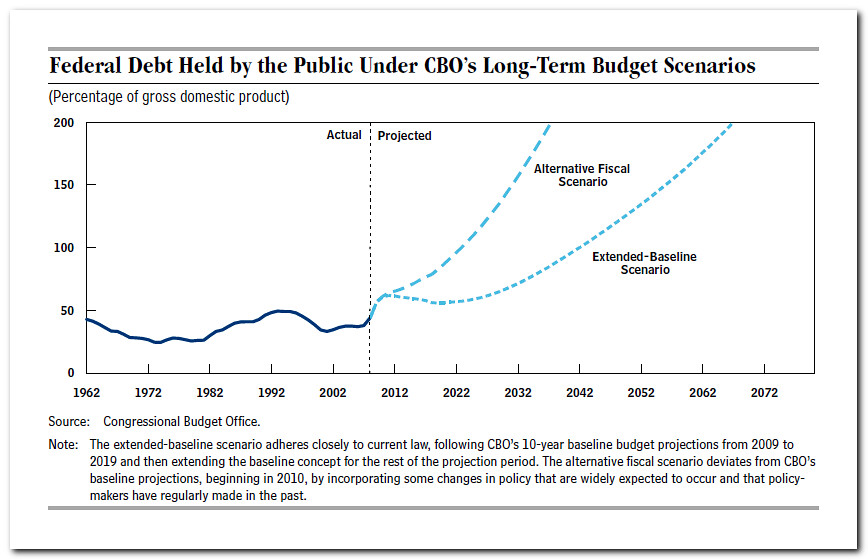

click to enlarge, double click to reduce

Federal Debt Scenarios by CBO, on Flickr

Excessive leverage remains the largest issue in the American economy. It was also the cause of the financial meltdown. Private debt holders have been deleveraging for the first time in a generation while the government and the Fed attempt to counteract its negative effect on spending. Now government debt, a slow simmering issue for decades, is beginning to structurally boil. The fact is that the banking industry and the Fed has a structural tendency to create entirely too much money and credit, and pundits of a variety of stripes have catalogued the asset bubbles that result in all the monetary recessions we have experienced in the last 50 years.

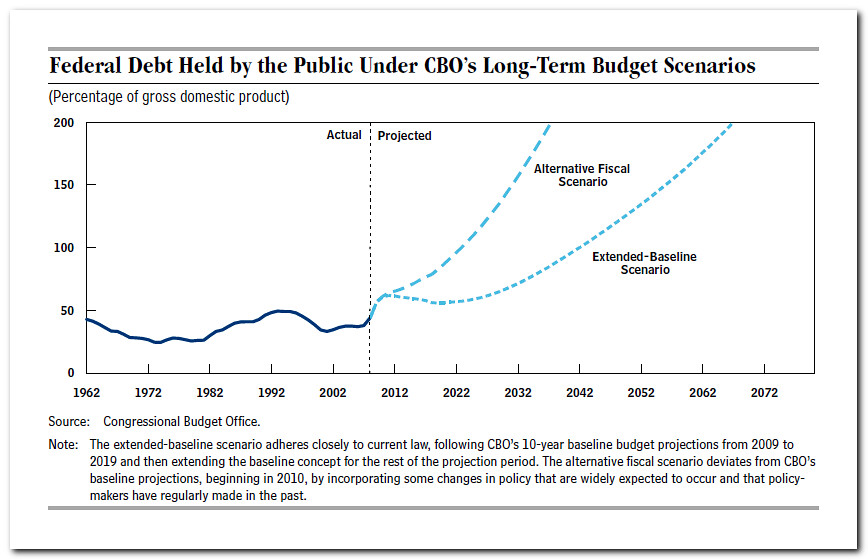

Federal Debt Scenarios by CBO, on Flickr

But the Dodd-Frank bill does not address the banking debt issue. In fact, it tends to protect exposure risk of over-leverage. Even Basil III does not address the fact that before the Federal Reserve system, banks typically held at least 25% in reserve (which was often not enough), while in today's heavily regulated environment banks typically hold less than 5%.

TARP only exacerbated this structural issue. It did not reprice the toxic assets that brought the system to its knees in the first place. It did the opposite; it rescued the debt that in any market would have almost immediately been repriced and written down. In that sense, critics were right; taxpayers bailed out the rich. The market has been trying ever since, so far unsuccessfully, to reprice that debt through real estate losses, foreclosures, and sales. The economy will not recover until those markets are repriced.

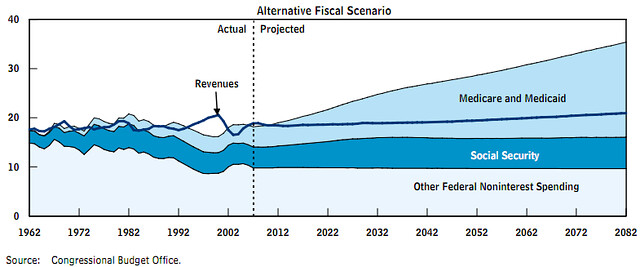

click to enlarge, double click to reduce

Deficit graph by Congression Budget Office, on Flickr

As to government debt, despite the media uproar on the Deficit Panel's suggestions, the core of the paper is very tame. It raises revenue by increasing taxes on the middle and upper classes, and gently reduces spending growth. It then depends on GDP growth to shrink deficit and debt levels over decades. It accomplishes these tasks by nibbling at the actuarial edges of key programs and reducing tax deductions of currently tax policy.

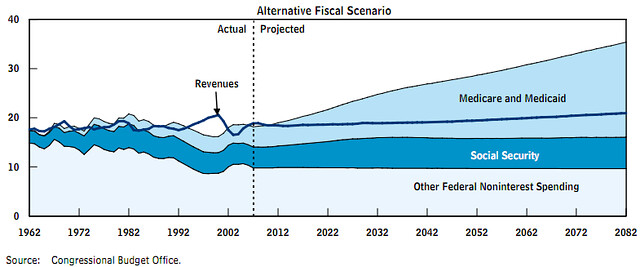

Deficit graph by Congression Budget Office, on Flickr

What it does not do is alter the structural issues which guarantee government deficits in the first place. Those structural issues are two. First, federal health care nets are economically unsound Ponzi schemes. Second, they are outlandishly unconstitutional. The tragic story behind these issues is that private industry knows very well how to provide these nets at decreasing cost, providing customers with secure annuities and inheritance windfalls for survivors. In other words, these programs are easy to fix even while they enrich the population instead of impoverishing them. There is no real world challenge to restoring these programs to fiscal sanity. That can be done quite easily. The solutions just do not conform to the Progressive narrative.

The issue at the Fed is even more perverse. They are adding to the problem by devaluing the dollar, adding structural leverage and generally delaying the repricing that a functioning economy demands. What is good for the banks is not what is good for the economy. They are delaying the economic recovery in order to preserve the large banks.

In all of these instances, all of the regulatory proposals are variations of the Progressive narrative. Even Paul Ryan's solution to the debt, labelled by Progressives as outlandishly 'right wing,' does not in any form include shrinking the federal government or delegating power back to local governments in order to prevent these issues in the future. As the most aggressive proposal to attack the structural issues of the federal morass, it only partly utilizes markets that have revolutionized the world in their ability to raise standards of living in economically sound solutions.

The issues with the economy are simple. We are too much in debt. And we are suffering from unsustainable government Ponzi scheme programs. In both instances, the Progressive narrative will not allow free market solutions, which remain very much in the minority in public discourse. They will remain there. The answers will be more taxes, and more deficits, and more sluggish growth, and more stagnant standards of living. We no longer understand how to have anything else.

No comments:

Post a Comment