But the premise of Keynes is that government can and should spend more than they receive during periods of recession, or top line aggregate demand failure. In private enterprise, there is no concept of revenue as 'aggregate demand.' Revenue is what it is, although increasing it is a popular business goal. But there is nothing inherently wrong if revenue declines or remains smaller compared to others.

The idea of aggregate demand is a fundamental disagreement between Keynes followers and his detractors. For in private enterprise, firms struggling for viability are almost never successfully treated by manipulating revenue or 'aggregate demand.' No successful turnaround plan includes expending significant resources on increasing sales. For sales are never the disease. The disease is always in one of two places; the firm is either inefficiently producing existing sales, or is producing the wrong products in the first place, and therefore finds buyers at unprofitable prices.

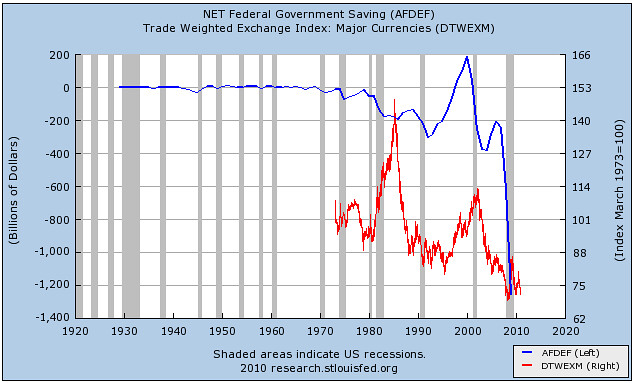

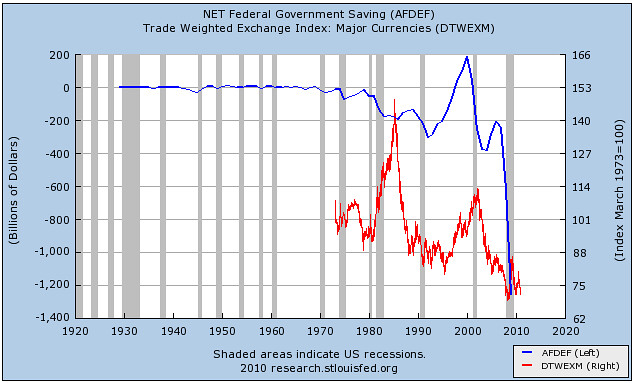

click to enlarge, double click to reduce

Federal Debt and the falling dollar

Therefore all turnarounds in private enterprise begin with spending cuts. It can not be any other way. Even if the firm stumbles on a huge and profitable sales contract, the disease remains, for in a competitive environment, the surplus profit from such sales will inevitably disappear as healthy firms attack the contracts with lower prices, again uncovering the persistent disease of the ailing firm.

Federal Debt and the falling dollar

Notice that a strict reading of Keynes does not significantly stray from this concept. His fundamental premise is that governments will in times of prosperity run at a surplus such that when revenues decline due to various forces (Keynes must spend extraordinary time on explaining what these forces are in order to justify aggregate demand fluctuation) they have excess reserves to spend to artificially inflate revenues until the economy 'recovers.'

Not even a Keynesian theory which stretches conceptual credulity in how the world works can propose continuous deficit spending. For if that was true, then governments could produce wealth merely by printing money. Even in the short run, deficit spending is by Keynes own definition a treatment with long term cost, an expensive and debilitating treatment not unlike heroin as a treatment of chronic pain.

And there lies one of the practical issues with Keynesian theory, even fro Keynesians; governments very quickly become addicted to heroin. It has been impossible to convince some doctors that Keynesian theory is fundamentally incorrect. But even Keynesian theorists must admit that governments and the Federal Reserve have been injecting heroin into the patient both in good times and bad. They can not in the long run stop spending. Keynes himself would shudder in his grave.

No doctor would prescribe heroin over long periods of time; the treatment eventually becomes as bad as the disease. Keynesians acknowledge this obvious point. Why then do we do it, as we have been since before WWII?

The injections come in two forms. The first is deficit spending, causing at the least a slow and steady decline in the dollar, with horrendously regressive effect on the poor. No economist disputes this point either. Their rejoinder is that it is on the whole more helpful than harmful.

The other argument for deficit spending is that other western nations are also addicted, and therefore the comparative loss is reduced. Of course this argument is akin to saying that since the rest of the world is high, it is ok if we are. But it also conveniently ignores the rest of the world who are struggling to climb out of poverty against nations that rob their currencies.

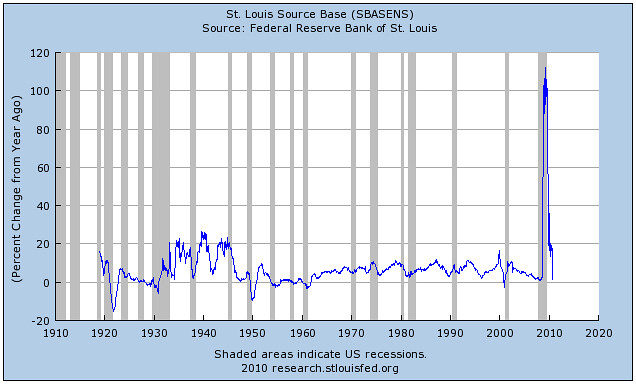

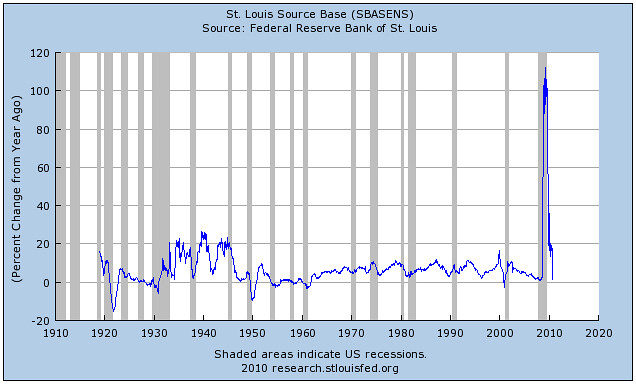

click to enlarge, double click to reduce

Base money percentage change: Fed printing

The other form of injection comes from the Federal Reserve, which prints new money, called high power money because it is leveraged through the banks as they lend out 5-10 dollars for every dollar printed. This new credit can in the short run spur demand and prices and profit margins, just as heroin gives the impression of health and vigor.

Base money percentage change: Fed printing

Notice even Chairmen of the Federal Reserve are careful to speak in 'conservative' terms, since they are forcefully aware that too much injection will cause disaster. But one of the defenses to chronic money printing has been how little it seems to have harmed the patient. Observers can not help but notice that these are the same statements of an addicted patient.

In summary, by their own lights, Keynesians must admit that the practical implementation of his theories have been anything but stellar, or structurally sound. The silence, along with the denial, is deafening.

For those of us who reject Keynes (and we thought everyone did some decades ago), the actions of the government and the Federal Reserve in the last 50 years are gobsmacking. After TARP, it is obvious that the government views that what is good for banks is good for the country. This is anything but the truth, and more than anything is driving politics and our economy today.

No comments:

Post a Comment