The Moody's Commercial Property Price Index (CPPI) has fallen 43.2 percent since its peak in October 2007. Raw-land and residential-lot values have fallen even further. Almost 3,000 of the 7,830 banks in the United States are loaded with real-estate loans where the collateral value has fallen over 40 percent, and yet less than 300 banks have failed?

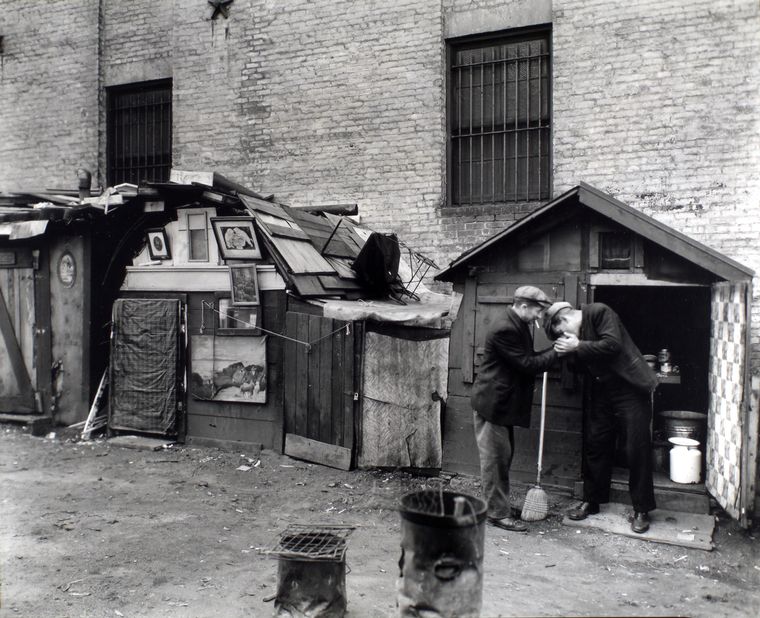

click to enlarge, double click to reduce

Huts and unemployed, West Houston and Mercer Street, Manhattan by New York Public Library, on Flickr

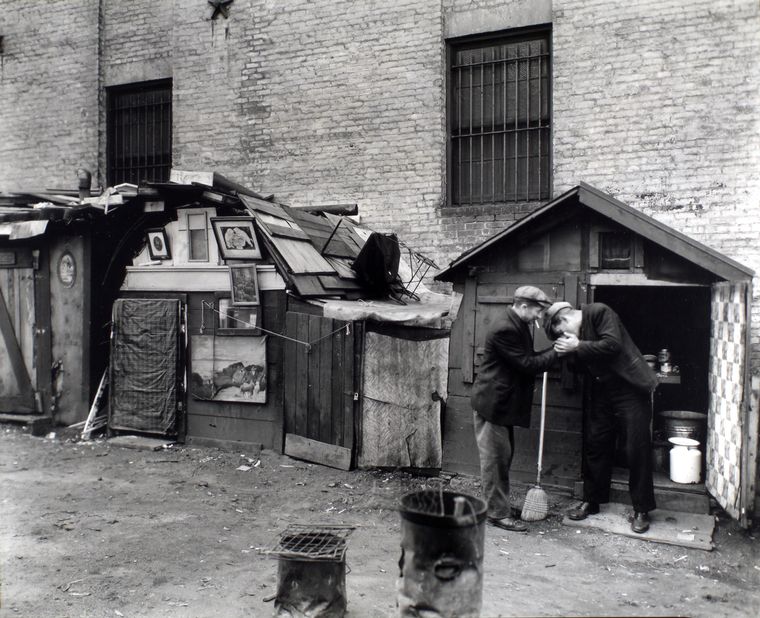

Huts and unemployed, West Houston and Mercer Street, Manhattan by New York Public Library, on Flickr

The question is a good one. For most of the banks are surely bankrupt, even as they report record profits. Consider these statistics:

Even the collective real estate loan portfolio of the 105 largest banks is 8.64 percent noncurrent (or over 90 days past due) and the big banks' construction and development portfolio is nearly 19 percent noncurrent.

These delinquency numbers are bad anyway you look at it. So, they must be reflected in bank's profit numbers, right? Well, no. Second-quarter earnings by the nation's banks were the highest in 3 years — nearly $22 billion.

Based on these numbers, FDIC chair Sheila Bair claims, "The banking sector is gaining strength. Earnings have grown, and most asset quality indicators are moving in the right direction, putting banks in a stronger position to lend."

Just a simple question. At what point do leaders have a fiduciary duty to speak up? Put more succinctly, "Is leadership defined by how much BS you are willing to spout for your organization when times are tough?" The emperor hath no clothes. Oh, but it gets worse:

And bankers must figure the coast is clear: they are cutting their provisions for bad debts. Yes, at a time when one out of four Americans has a sub-600 FICO score, a quarter of all homeowners are underwater on their mortgages, and commercial real estate is hitting the ditch, banks are dipping into their loan-loss reserves to report profits.

Just what is it that we're doing? We realize that sometimes plans can not be perfect. We have to press on in the face of adversity. At what point though, are we propagating a sham? And are we not aware that by saving the banks we are spreading their pain elsewhere? Are we really that naive?

More importantly, these banks were the primary beneficiaries of accounting-rule changes in April of 2009 — amendments to FASB rules 157, 115, and 124, allowing banks greater discretion in determining at what price to carry certain types of securities on their balance sheets and recognition of other-than-temporary impairments.

So we have the FASB helping the banks look like they are still viable. And from the Congressional Oversight Panel:

Ms. Warren noted that office vacancies had increased 25 percent since 2006–2007, apartment vacancy was up 35 percent, industrial was up 45 percent, and retail vacancy had increased 70 percent since 2006–2007. The report said the recovery rate for defaulted real-estate loans was 63 percent last year. Land-loan recoveries were only 50 percent. Development-loan recoveries were even worse at 46 percent.

I strongly urge you to read the entire article. For something is terribly, structurally wrong. And it is unlikely that it can be simply explained as an effort to 'save' the economy. Just whose jobs are we saving? And at whose expense?

No comments:

Post a Comment